When it comes to managing your finances, understanding how to calculate your installment loan payments is crucial. Whether you’re considering a personal loan, an auto loan, or a mortgage, knowing how much you’ll owe each month helps you budget effectively. In this comprehensive guide, we will break down everything you need to know about calculating your installment loan payments, equipping you with the skills to do it like a pro.

Understanding Installment Loans

Before we dive into the calculations, let’s clarify what an installment loan is. An installment loan is a type of loan that is paid off over time with a set number of scheduled payments. Typically, these payments are made monthly and consist of both principal (the amount borrowed) and interest (the cost of borrowing). Common types of installment loans include:

- Personal Loans: Unsecured loans for personal use, often used for debt consolidation or major purchases.

- Auto Loans: Secured loans specifically for purchasing a vehicle.

- Mortgages: Secured loans used to buy real estate, where the property serves as collateral.

Understanding these loans’ structure will help you make informed financial decisions.

Key Components of an Installment Loan

To calculate your installment loan payments, you need to familiarize yourself with the following key components:

- Principal Amount (P): The total amount of money borrowed.

- Interest Rate (r): The annual percentage rate (APR) charged on the loan. It’s essential to convert this annual rate into a monthly rate for calculations.

- Loan Term (n): The duration of the loan, typically measured in months. For example, a 5-year loan has 60 months.

- Monthly Payment (M): The total amount you’ll pay each month, which includes both principal and interest.

The Formula for Calculating Monthly Payments

The most common formula used to calculate monthly installment payments is derived from the amortization formula:

M=P×r121−(1+r12)−nM = \frac{P \times \frac{r}{12}}{1 – (1 + \frac{r}{12})^{-n}}

Where:

- MM = Monthly payment

- PP = Principal loan amount

- rr = Annual interest rate (as a decimal)

- nn = Total number of payments (months)

Step-by-Step Breakdown of the Formula

- Convert the Annual Interest Rate to a Monthly Rate:

- Divide the annual interest rate by 12. For example, if your annual interest rate is 6%, then your monthly rate would be 0.06/12=0.0050.06/12 = 0.005.

- Calculate the Total Number of Payments:

- Multiply the number of years of the loan term by 12. For a 5-year loan, this would be 5×12=605 \times 12 = 60.

- Insert the Values into the Formula:

- Substitute your values for PP, rr, and nn into the formula.

- Perform the Calculations:

- This can be done using a calculator, spreadsheet software, or manually.

Example Calculation

Let’s consider an example to see how this formula works in practice.

Scenario:

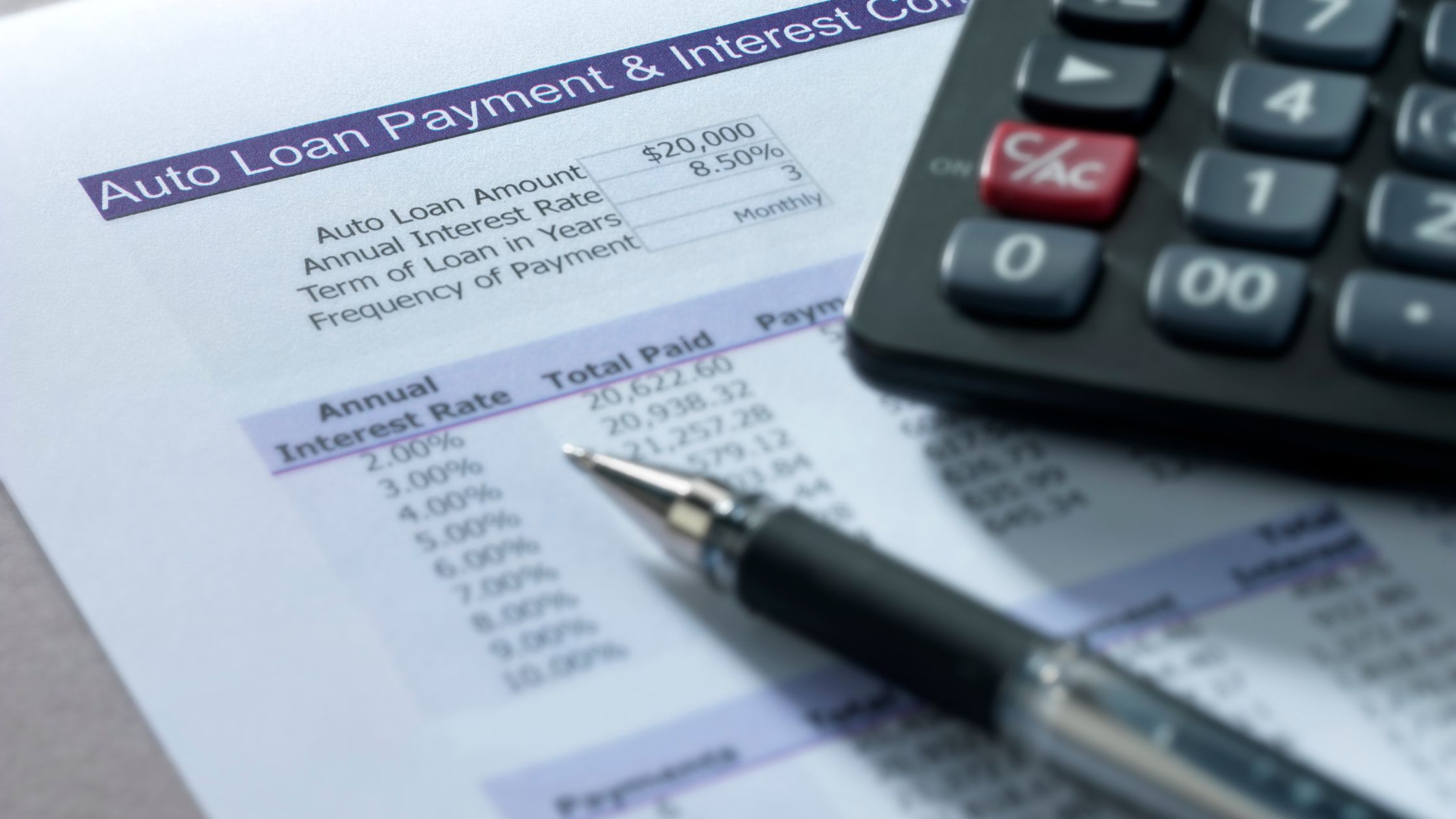

- Principal Amount (P): $20,000

- Annual Interest Rate (r): 6%

- Loan Term (n): 5 years

Step 1: Convert Interest Rate

r=0.06(annual)r = 0.06 \quad \text{(annual)}

Monthly interest rate:

0.0612=0.005\frac{0.06}{12} = 0.005

Step 2: Calculate Total Payments

n=5×12=60(months)n = 5 \times 12 = 60 \quad \text{(months)}

Step 3: Plug into the Formula

M=20000×0.0051−(1+0.005)−60M = \frac{20000 \times 0.005}{1 – (1 + 0.005)^{-60}}

Step 4: Calculate

M=1001−(1.005)−60M = \frac{100}{1 – (1.005)^{-60}}

Calculating the denominator:

(1.005)−60≈0.740818(1.005)^{-60} \approx 0.740818 1−0.740818≈0.2591821 – 0.740818 \approx 0.259182

Now, plug this back into the equation:

M=1000.259182≈386.37M = \frac{100}{0.259182} \approx 386.37

Monthly Payment: Approximately $386.37.

Tools for Calculating Installment Payments

While you can calculate your installment loan payments manually, several tools can make the process quicker and easier:

1. Online Loan Calculators

There are numerous online calculators that can do the math for you. Simply input your loan amount, interest rate, and term, and the calculator will provide your monthly payment.

2. Spreadsheet Software

Programs like Microsoft Excel or Google Sheets have built-in functions that can calculate loan payments. The formula to use in Excel is:

=PMT(r/12,n,−P)=PMT(r/12, n, -P)

3. Financial Apps

Many budgeting and financial management apps offer loan calculators as part of their features. These apps often allow you to track multiple loans, helping you stay organized.

Understanding Amortization Schedules

An amortization schedule is a detailed table showing each payment over the life of the loan. It breaks down how much of each payment goes toward interest and how much goes toward reducing the principal balance. Understanding this schedule can help you see how your payments are structured and how your debt decreases over time.

How to Create an Amortization Schedule

To create an amortization schedule:

- List the Total Number of Payments: Include all monthly payments from 1 to nn.

- Calculate Interest for Each Payment: Multiply the remaining principal by the monthly interest rate.

- Determine Principal Payment: Subtract the interest payment from the total monthly payment.

- Update Remaining Balance: Subtract the principal payment from the remaining balance.

- Repeat for Each Payment Until the Loan is Paid Off.

Example of an Amortization Schedule Entry

Using our previous example of a $20,000 loan with a 6% interest rate:

- Month 1:

- Monthly Payment: $386.37

- Interest Payment: $100.00 (20,000 x 0.005)

- Principal Payment: $286.37 (386.37 – 100.00)

- Remaining Balance: $19,713.63 (20,000 – 286.37)

Continue this process for each month until the loan is paid off.

Factors Affecting Your Installment Loan Payments

Several factors can influence your monthly installment payments:

1. Interest Rates

A lower interest rate results in lower monthly payments. Rates can vary based on your credit score, loan type, and lender.

2. Loan Amount

The more money you borrow, the higher your monthly payment will be. Always consider how much you truly need to borrow.

3. Loan Term

Shorter loan terms usually come with higher monthly payments but less interest paid over the life of the loan. Conversely, longer terms reduce monthly payments but can lead to paying more interest overall.

4. Credit Score

Your credit score can significantly impact the interest rate you receive. Higher scores often qualify for better rates, leading to lower monthly payments.

5. Fees and Additional Costs

Consider any additional fees (origination fees, insurance, etc.) that might affect your overall cost of borrowing.

Tips for Managing Installment Loan Payments

Here are some practical tips to help you manage your installment loan payments effectively:

1. Create a Budget

Understanding your monthly income and expenses is essential for managing your loan payments. Allocate a portion of your budget specifically for loan repayments.

2. Set Up Automatic Payments

Automating your payments can help ensure you never miss a due date, avoiding late fees and potential damage to your credit score.

3. Make Extra Payments When Possible

If your loan allows it, consider making extra payments toward the principal. This can reduce the total interest you pay over the loan’s lifetime and help you pay off the loan faster.

4. Stay Informed About Refinancing Options

If interest rates drop significantly after you take out your loan, refinancing might be a good option. This could allow you to secure a lower rate and reduce your monthly payments.

5. Maintain Open Communication with Your Lender

If you find yourself struggling to make payments, contact your lender. They may offer options such as deferment, forbearance, or loan modification.

Also Read: Installment Loans vs. Personal Loans: Which One Saves More?

The Bottom Line

Calculating your installment loan payments doesn’t have to be a daunting task. With a clear understanding of the key components and formulas involved, you can confidently determine your monthly payments. Whether you choose to calculate manually or use online tools, the skills you gain will empower you to make informed financial decisions.

Remember to keep an eye on your budget, explore ways to minimize your loan costs, and maintain open lines of communication with your lender. By managing your installment loans wisely, you’ll be well on your way to achieving your financial goals. Happy calculating!